-40%

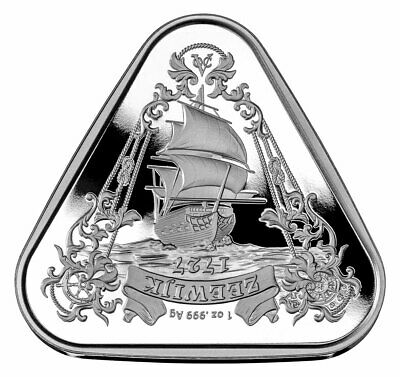

::NEW:: CREDIT CARD 70th Anniversary Silver Coin 2$ Niue 2020 with Hologram

$ 205.92

- Description

- Size Guide

Description

*** EXTREMELY RARE COIN! TAKE ADVANTAGE! ***THE MARKET PRICES ARE GOING UP AND ONLY A FEW COMPANIES HAVE IT AVAILABLE

EXCELLENT INVESTMENT OPPORTUNITY!

CREDIT CARD COIN

"Commemorative coin 70 years of credit card invention"

CREDIT CARD SHAPE :: SECURITY HOLOGRAM :: MAGNETIC STRIPE ::

SIGNATURE STRIPE

::

SERIAL NUMBER

No cash? Get the coins rolling with the magic card! What seemed like an utopian concept in a late 1800s novel, started to take real form in the first half of the 20th century. The first credit-card-like payment method showed up in 1950 when Ralph Schneider and Frank McNamara founded Diners Club and issued its first cards.

Over the years, credit cards have evolved. Magnetic strips were added, then EMV chips. More than 70% of adults now own at least one credit card, adding up to around 2.8 billion active cards worldwide.

This year we celebrate the 70th anniversary of this revolutionary invention and Artmint decided to take part by creating an exquisite coin imitating a real life credit card. Within the exact measurements conforming to the ISO/IEC 7810 ID-1 it contains every important element - including a magnetic stripe, a real hologram, a chip imitation and it doesn´t lack an area for signature.

Each coin is marked by its individual serial number, ensuring its authenticity. The coin itself is enclosed in an elegant box, including the Certificate.

*** Extremely rare! Limited to 500 coins worldwide and SOLD OUT at the mint! ***

Country:

Niue

Year:

2020

Face value:

2 Dollars

Metal:

Silver 999.

Weight (g):

46.46 (1.5 oz)

Size (mm):

85,6 x 54 (standard credit card size)

Quality:

Inversed Proof

Mintage (pcs):

500

Certificate COA:

Yes

Box:

Yes

BACKGROUND AND HISTORY

Here’s a quick timeline of the history of credit cards:

1950: Diners Club issues the first charge card

1958: Bank of America issues the first general-purpose credit card that offered a “revolving credit” feature

1958: American Express Company issues a travel and entertainment payment card

1969: Magnetic strip standard is adopted in the U.S.

1976: Bank of America spins off BankAmericard and joins with other banks to create Visa

1979: Mastercard brand comes into existence, formerly the Interbank Card Association and Master Charge

1986: As a subsidiary of Sears, Dean Witter Financial Services Group launches the Discover Card

2015: EMV chips become standard to help protect buyers against fraudulent card transactions

* * *

After Diners Club issued its first charge card in 1950, the payment card began evolving into what we know as the credit card today. In 1958, American Express Company jumped into the payment card scene and launched its first charge card.

In 1958, Bank of America launched BankAmericard. This paper card could be considered the first modern credit card. The BankAmericard came with a 0 limit and was the first credit card to offer revolving credit, which gave people the ability to carry a balance. In 1970, BankAmericard was spun off into National BankAmericard, Incorporated, an interbank card association that issued and managed credit cards. In 1976, National BankAmericard, Inc. became Visa.

In 1979, Mastercard was formed. Before it was called Mastercard, the company was formed as The Interbank Card Association in 1967. It then rebranded itself as Master Charge in 1968 before its final change in 1979.

And finally, we have the Discover Card, which was launched nationally in 1986 by Dean Witter Financial Services Group, Inc. which was a subsidiary of Sears.

Credit cards didn’t always have magnetic strips or EMV chips. Before magnetic strips, machines would take imprints of credit cards to capture the information needed to process payments. The copy would be sent to a processing center where a clerk could enter a person’s credit card account information into a computing system.

In 1969, IBM helped develop a standard for magnetic strips that would eventually be adopted internationally. This standard allowed credit cards to use magnetic strips to transmit card information worldwide.

Until recently, magnetic strips were the most common way of storing and transmitting card information. A new technology, called the EMV chip, aimed to make credit card transactions more secure. These chips generate unique, one-time codes to approve transactions and are considered more secure than static magnetic strip information.

PARIS COINS

Coins for investors and collectors