-40%

Pennsylvania Railroad PRR 1960s GREEN Stock Certificate Horse Shoe Curve F+

$ 1.05

- Description

- Size Guide

Description

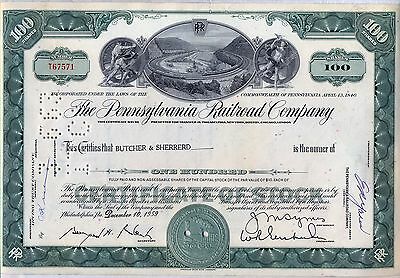

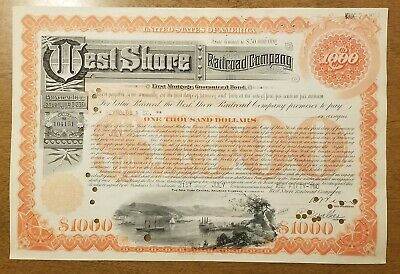

The Pennsylvania Railroad CompanyCapital Stock Certificate - GREEN

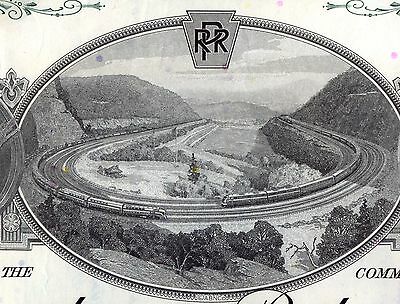

1950/60s Horseshoe Curve Vignette

Pennsylvania Railroad Stock Certificate

--- Horseshoe Curve Vignette 1957-1968 ---

Green 100 share stock certificate from the late great Pennsylvania Railroad, printed by the American Bank Note Company on heavy certificate bond. Introduced in 1957, the Horseshoe Curve type would be the last style of stock certificate used by the PRR prior to its merger with New York Central Railroad in 1968. The certificate you will receive will have been issued between 1957 and 1968. Bright, crisp and clean, these are quality display pieces.

STOCK UP and Save on Shipping!

Pay shipping on the FIRST Buy-It-Now lot and all other Buy-It-Now lots ship free!

Certificate features: Pennsylvania 1846 incorporation seal, par value. Facsimile signatures corporate officers. Hand signature transfer agents.

An example of the vignette -

Printed on crisp certificate bond paper by the American Bank Note Company. The certificates are in Fine to VF+ condition, still crisp, and do not have any distracting rips, tears, seps, or heavy ink cancels on the face of the stocks. They have been punch and/or stamp cancelled, and while not discolored or heavily toned, will have the usual staple holes from transfer slips. Folds and/or creases from handling are slight and do not detract. Occasional broker marginalia, non-detracting. All staples have been removed, as have all attached transfer slips.

This item was hand selected for its display quality from among literally

thousands

of certificates and is nothing like some of the dreck that you'll find on eBay.

Names and dates will vary - but the Quality, will not! ---

Please see my

Other Items

for more, and be sure to add me to your

favorites list

!

Thumbnail History...

Chartered in 1846, the Pennsylvania Railroad was nicknamed the Pennsy and styled itself as "The Standard Railroad of the World." With its stranglehold on the mid-Atlantic regional rail system it was at one time the most powerful railroad (and corporation,) in the country, if not on the planet.

Founded by a group of Philadelphia merchants, the objective was to construct a through railway to Pittsburgh Pennsylvania, and thereby secure for the City of Brotherly Love the inland trade that was at risk of being siphoned off by the Baltimore and Ohio Railroad. In Western Pennsylvania, isolated as it was from the East by the Appalachian Mountain range, Nature had conspired to create a topography that favored a south-easterly flow of commerce.

Early on, the government of the Commonwealth of Pennsylvania recognized the success that New York state had had with its Erie Canal. Pennsylvania had tried to emulate the Mohawk Valley project with the "Main Line of Public Works." What it developed was a multipart transportation system utilizing canals, rails, and a portage railroad over the Allegheny mountains. Although it did reduce travel time between Philadelphia and Pittsburgh by nearly two-thirds, it was still inefficient, and its tonnage capacities were nowhere substantial enough to meet the demands of the booming steel and coal region.

The Philadelphia merchants realized that they were on the verge of loosing a very lucrative market if they did not get a modern transportation system in place, and so they petitioned the legislature to charter their all rail route across the Keystone State.

After a bruising legislative battle pitting most of Western Pennsylvania against the Philadelphia interests, on 13 April 1846, a charter for a 'Central Railroad' spanning Pennsylvania from East to West, was signed by the governor. At the same time, however, a competing charter allowing the B&O to enter Pittsburgh was also signed into law. To hasten the work, the articles mandated the PRR to have thirty miles of track either laid or under contract, and to have million worth of their stock subscribed to by the end of July 1847. If those conditions were met, the B&O Act would be held null and void.

Not only did the PRR supporters raise the capital which the law required, but they exceeded it, so bright were the line's prospects. In 1852 it opened the first direct all rail connection to Pittsburgh. Continuous through passenger service from Philadelphia to Pittsburgh was introduced on 18 July 1858. That inaugural train also bore the distinction of featuring the first smoking lounge as a regular feature of its consist.

Over the next five decades the Pennsylvania Railroad grew at a remarkable pace. Profiting greatly in the Civil War, it absorbed hundreds of smaller lines, laid thousands of miles of track, and eventually reached from the Atlantic Coast to the banks of the Mississippi River. Its strength as a business was unmatched, and for over 120 years its common stock would pay a regular dividend.

Shortly after World War Two the fortunes of the entire railroad industry began to wane. Especially hard hit were the already declining Eastern Trunk Lines. Cars, trucks, busses, ships and airplanes - all indirectly subsidized by Federal tax dollars - ate steadily into traffic. Concurrently, industry began to shift to cheaper locales, and the manufacturing base that these lines had been built to serve, slowly drifted away from them. And, there was the dead hand of history to contend with: Because of the excesses and sometimes "robber-baron" tactics of certain early managements and investors, these railroads would find themselves mistrusted, over-regulated, and legally constrained from reacting in a timely manner to changing business conditions. In slightly over two generations, America's railroads had collectively gone from being bleeding-edge industrial innovators, to emasculated mossbacks.

High rates of taxation were also problematic for the Eastern roads in particular; many thousands of miles of track were located in urban areas, as were the empty palatial train stations, which the public had largely abandoned by the 1960s. All of these assets were subject to very heavy real estate taxes that competitors, such as truckers for instance, easily avoided. Huge fixed costs, a slothful response to change, "feather-bed" labor agreements, nimble competitors subsidized by the Federal government, and over-regulation were all important elements contributing to the collapse of the Eastern railroads.

By the late 1950s the management of the PRR was actively searching for a way out of the eroding earnings morass brought about by the railroad's decline. Attempts at diversification were undertaken by developing some of the vast PRR real estate holdings in New York City, Philadelphia, St. Louis and elsewhere, but these attempts could only achieve so much for the ailing company.

Since the First World War, conventional wisdom had been that "consolidation" or the creation by merger of a group of "super-railroads" for the country, was the only cure for the railroad blues. To James M. Symes, the thirteenth president of the PRR, that idea meant that there was only one suitor for his railroad - its arch-rival, the New York Central Railroad.

The potential for what today would be called "synergies," implicit in a PRR/NYC merger were as real as they were great: the two lines operated in the same territory, served many of the same customers, had billions in capital locked-up in duplicated infrastructure, and operated almost identically under rules that had been imposed upon them by the ICC, and the unions. In 1957, when Symes first floated the idea, it had solid business sense behind it. Initial studies estimated combined operating savings on the order of 0 million a year.

However, the auguries never proved right for the merger. Negotiations and legal challenges dragged on for a decade, and that lost time figured greatly in the eventual failure. Eleven years after it was proposed, in January of 1968, the Supreme Court of the United States gave its blessing to the merger of the PRR and NYC, thus bringing about the ill-fated Penn Central. Born on the 1st of February 1968, it filed for bankruptcy on the 21st of June, 1970. At the time, it was America's sixth largest company, and its largest business failure to date. Adjusted for inflation, and just until the Great Recession began, it still ranked in the top ten all-time greatest U.S. business failures.

As per eBay rules: These obsolete stocks, bonds and financial instruments, are sold as collectibles

only

. Unless otherwise stated, each item has been punch and/or stamp cancelled. Again, unless otherwise stated, all items will grade at FINE or better. Illustrations provided for reference only; except where noted, actual items may vary.

BILLING, PAYMENTS & SHIPPING

PLEASE NOTE:

This is a

SELF SERVE AUCTION

. If you're a successful bidder, the only e-mail you will receive regarding this lot will be generated through the eBay system. Applicable shipping discounts for multiple purchases, etc. can be totaled through the eBay Check-out service which is HIGHLY RECOMMENDED for you to use. Payment is expected within TEN (10) days, including weekends. If payment is not received within that time, the item will be re-listed, and appropriate feedback will be left. POSITIVE feedback will be left at the successful conclusion of this sale.

DOMESTIC U.S. SHIPPING

: This item ships safely packaged in

FLAT

condition via USPS First Class Mail.

YES! Will combine multiple lots -

except where noted.

INTERNATIONAL SHIPPING

: This item ships safely packaged in

FLAT

condition via USPS International Mail. Rates are calculated by the eBay system.

YES! Will combine multiple lots -

except where noted.

BID WITH CONFIDENCE!

DOING THE eBay THING SINCE 1997