-40%

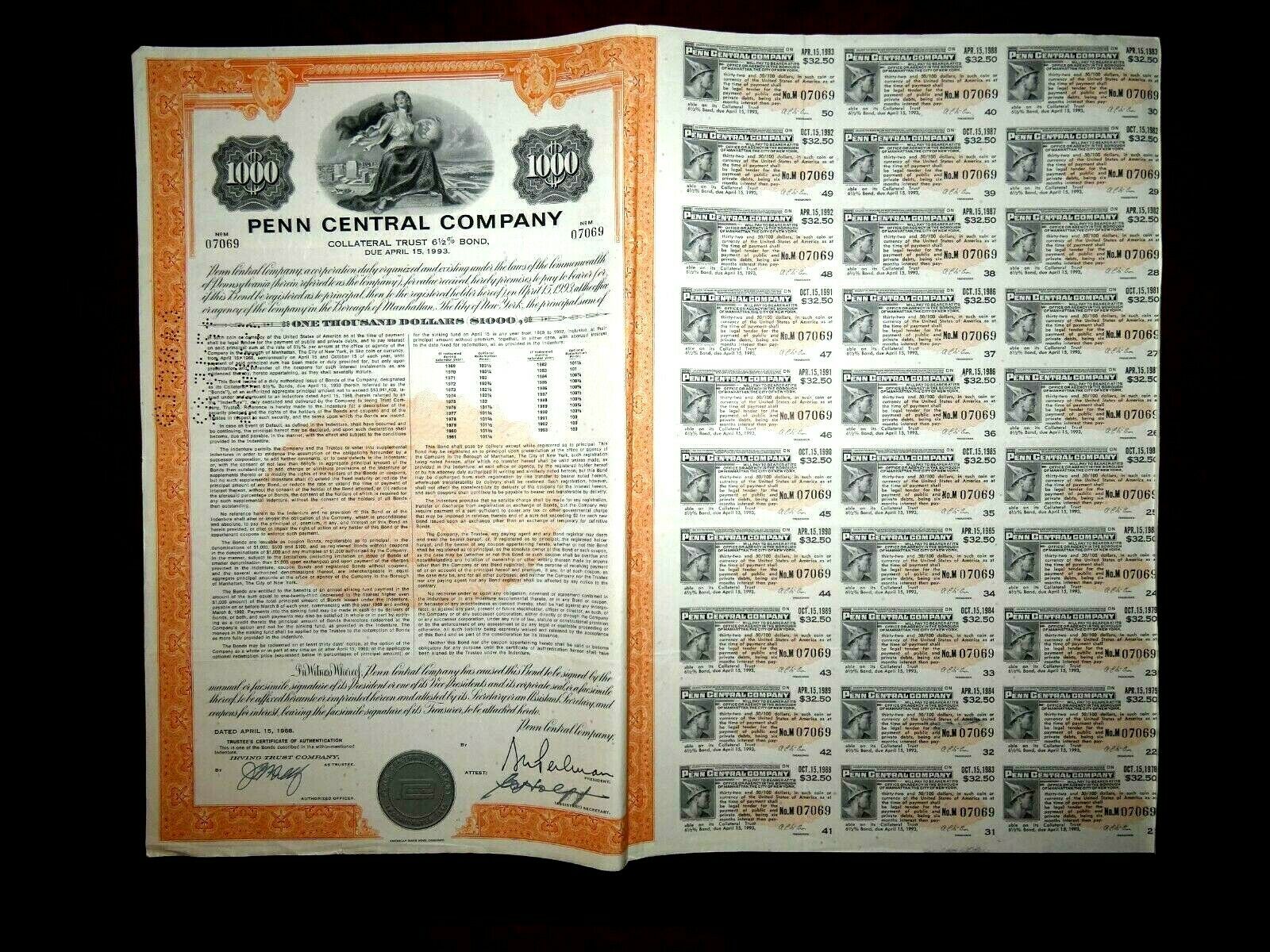

Penn Central Company Collateral trust bond 1968

$ 10.56

- Description

- Size Guide

Description

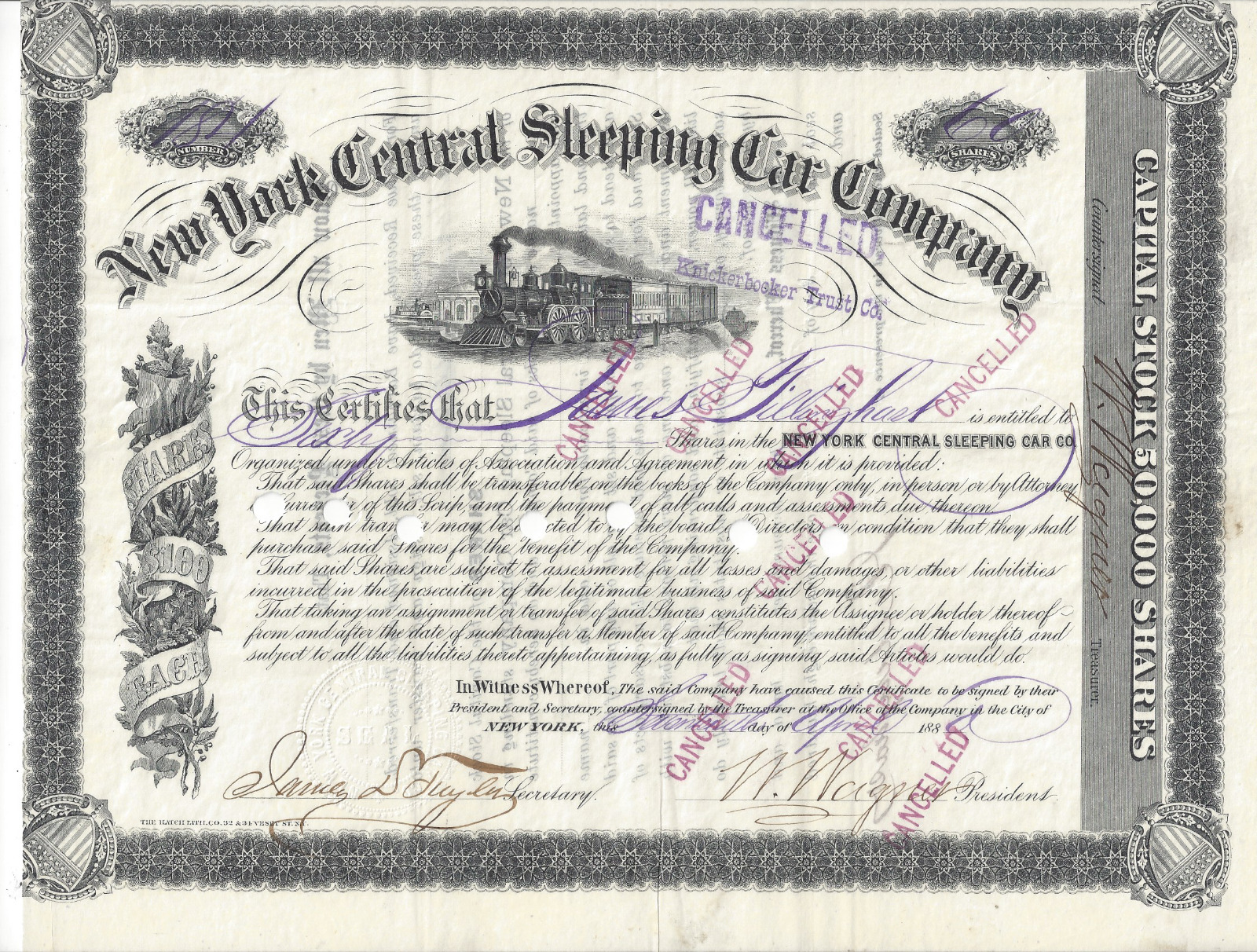

One bearer certificate of "Penn Central Company Collateral trust 6 1/2 % bond 1968

00 ".Condition (opinion) : Fine (F)

,see scan.Certificate measures: 38,7 cm x 25,5cm (certificate only).Printer:American Banknote Company. Contains uncut coupons (from Nr 20 to 50).Low serial number (273).Perforated at upper right with "4.9.79 CLD.1PA"

This is and old document for collection with historic or scripophilic

value only.

This document, because of its size, could be sent folded.

-------------------------------------------------------------

Postage, including packing material, handling fees : Europe: USD 4.10 / USA $ 4.90. Rest of the World: USD 6.10

FREE of postage for any other additional banknote , stocks & bonds or other items

.

Only one shipping charge per shipment (the highest one) no matter how many items you buy (combined shipping).

Guaranteed genuine -

One

month

return

policy

(retail sales)

.

When

there is

more than

one

item

for sale

the serial number

may

differ

from that shown

in

the

picture.

Customers are invited

to

combine

purchases to save

postage.

Full refund policy ,including shipping cost,guaranteed in case of lost or theft after the completion of the complaint with Spanish Correos for the registered letters (purchases above $ 40.00).

Customers are invited

to

combine

purchases to save

postage.

As we have (or could have) more than one identical item ,the serial number may differ from those shown in the picture which is for reference only.

For purchases above .00 we send the orders registered with tracking number without extra charge, for purchases below .00 we ship as regular letters at the buyer's risk.

For purchases below $ 40,00 who want to register your letter with tracking number, please add an extra for : Europe .00 , U.S. .00 ,Rest of the word .00

For some destinations and purchases below .00 customers may be requested for a small extra shipping payment in order to register the shipment with tracking number.

------------------------------------------------------------------------------

Banknote Grading

UNC

AU

EF

VF

F

VG

G

Fair

Poor

Uncirculated

About Uncirculated

Extremely Fine

Very Fine

Fine

Very Good

Good

Fair

Poor

Edges

no counting marks

light counting folds OR...

light counting folds

corners are not fully rounded

much handling on edges

rounded edges

Folds

no folds

...OR one light fold through center

max. three light folds or one strong crease

several horizontal and vertical folds

many folds and creases

Paper

color

paper is clean with bright colors

paper may have minimal dirt or some color smudging, but still crisp

paper is not excessively dirty, but may have some softness

paper may be dirty, discolored or stained

very dirty, discolored and with some writing

very dirty, discolorated, with writing and some obscured portions

very dirty, discolored, with writing and obscured portions

Tears

no tears

no tears into the border

minor tears in the border, but out of design

tears into the design

Holes

no holes

no center hole, but staple hole usual

center hole and staple hole

Integrity

no pieces missing

no large pieces missing

piece missing

piece missing or tape holding pieces together

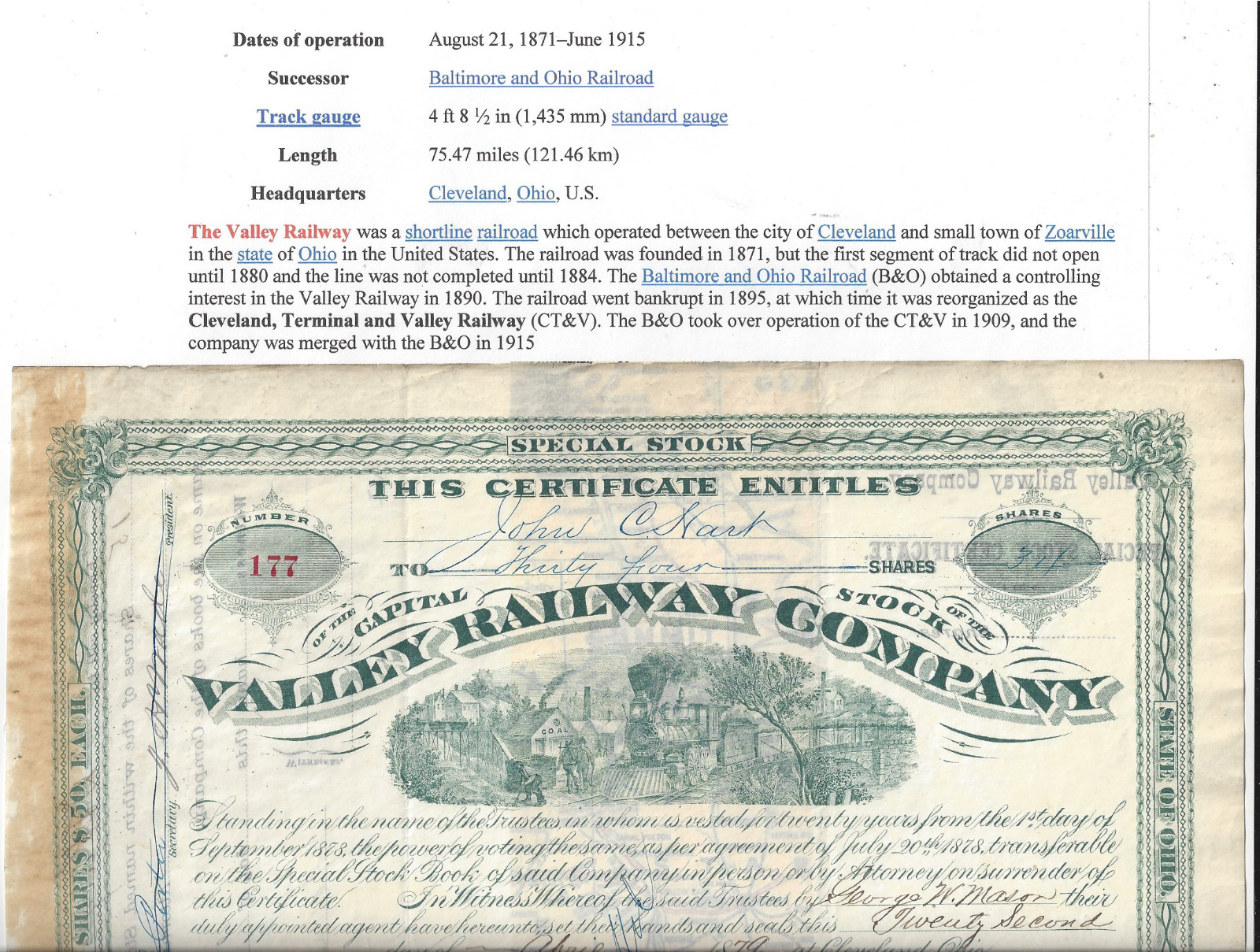

See below related information from the web:

The Penn Central Transportation Company, commonly abbreviated to Penn Central, was an American Class I railroadheadquartered in Philadelphia, Pennsylvania, that operated from 1968 until 1976. It was created by the 1968 merger of thePennsylvania and New York Central railroads. The New York, New Haven & Hartford Railroad was added to the merger in 1969; by 1970, the company had filed for what was, at that time, the largest bankruptcy in U.S. history.

Background of the merger[edit]

The Penn Central was created as a response to challenges faced by all three railroads in the late 1960s. The northeastern quarter of the United States, these railroads' service area, was the most densely populated region of the U.S. While railroads elsewhere in North America drew a high percentage of their revenues from the long-distance shipment of commodities such as coal, lumber,paper and iron ore, Northeastern railroads traditionally depended on a mix of services, including:

Commuter rail service

Passenger rail service

Railway Express Agency freight service

Break-bulk freight service in boxcars

Consumer goods and perishables, such as fruit and dairy products

These labor-intensive, short-haul services were all vulnerable to competition from automobiles and buses (for the first two services) and the trucking industry (for the remaining three), particularly where facilitated by four-lane highways. In 1956, Congress had passed, and President Dwight D. Eisenhower had signed, the Federal-Aid Highway Act of 1956. This law authorized construction of the massive Interstate Highway System, which provided an economic boost to the trucking industry.[1]

Another significant problem was the inability of the New York Central and Pennsylvania railroads to respond to market conditions. The railroad industry at the time was heavily regulated by the Interstate Commerce Commission (ICC) and was unable to change the rates it charged shippers and passengers. Therefore, reducing costs was the only way to become more profitable. Government regulation and agreements with labor unions tightly restricted what cost-cutting could take place. A merger seemed to be a promising way out of a difficult situation.

The merged railroad[edit]

As it turned out, the merged Penn Central was little better off than its constituent roads were before. A merger implementation plan was drawn up, but not carried out. Attempts to integrate operations, personnel and equipment were not very successful, due to clashing corporate cultures, incompatible computer systems and union contracts.[2]:233–234 Track conditions deteriorated (some of these conditions were inherited from the three merged railroads) and trains had to be run at reduced speeds. This meant delayed shipments and personnel working a lot of overtime. As a result, operating costs soared. Derailments and wrecks became frequent, particularly in the midwest.[3]

Penn Central management created a holding company, the Penn Central Company, and tried to diversify the troubled firm into real estate and other non-railroad ventures, but in a slow economy these businesses performed little better than the railroad assets. In addition, these new subsidiaries diverted management attention away from the problems in the core business. To make matters worse, management insisted on paying dividends to shareholders to create the illusion of success. The company had to borrow more and more to keep operating. The interest on the loans became an unbearable financial burden.

In 1968 most of Maine's potato production rotted in the PC's Selkirk Yard, dooming the Bangor & Aroostook Railroad, whose shippers vowed never to ship by rail again.[citation needed]

Bankruptcy and Conrail merger[edit]

The American financial system was shocked when after only two years of operations, the Penn Central Transportation company was put into bankruptcy on June 21, 1970.[3] It was the largest corporate bankruptcy in American history at that time. Although the Penn Central Transportation Company was put into bankruptcy, its parent Penn Central Company was able to survive.[4]

The Penn Central's bankruptcy was the final blow to long-haul private-sector passenger train service in the United States. The troubled company filed proposals with the ICC to abandon most of its remaining passenger rail service, causing a chain reaction among its fellow railroads. In 1971 Congress created Amtrak, a government corporation, which began to operate a skeleton passenger service on the tracks of Penn Central and other U.S. railroads.

The Penn Central continued to operate freight service under bankruptcy court protection. After private-sector reorganization efforts failed, Congress nationalized the Penn Central under the terms of the Railroad Revitalization and Regulatory Reform Act of 1976. The new law folded six northeastern railroads, the Penn Central and five smaller, failed lines, into the Consolidated Rail Corporation, commonly known as Conrail. The act took effect on April 1, 1976.[5]

Facing continued loss of market share to the trucking industry, the railroad industry and its unions were forced to ask the federal government for deregulation. The 1980Staggers Act, which deregulated the railroad industry, proved to be a key factor in bringing Conrail and the old Penn Central assets back to life.[6]

During the 1980s, the deregulated Conrail had the muscle to implement the route reorganization and productivity improvements that the Penn Central had unsuccessfully tried to implement during 1968 to 1970. Many miles of old Pennsylvania and New York Central track were abandoned to adjacent landowners or rail trail use. The stock of the subsequently-profitable Conrail was refloated on Wall Street in 1987, and the company operated as an independent, private-sector railroad from 1987 to 1999.

Corporate history[edit]

The Pennsylvania New York Central Transportation Company was formed February 1, 1968, as an absorption of the NYC by the PRR. The trade name of "Penn Central" was adopted, and on May 8, the company was officially renamed to the Penn Central Company.

The Penn Central Transportation Company (PCTC) was incorporated on April 1, 1969, and its stock was assigned to the new Penn Central Holding Company. On October 1, the PCTC merged into the Penn Central Company. The next day, the Penn Central Company was renamed to the Penn Central Transportation Company, and the Penn Central Holding Company became the Penn Central Company.

The old Pennsylvania Company, a holding company chartered in 1870, reincorporated in 1958, and long a subsidiary of the PRR, remained a separate corporate entity throughout the period following the merger. While the PCTC had been merged into Conrail in 1976, the holding company, the Penn Central Company, continued as a separate firm. In the 1970s and 1980s, the new PC was a small conglomerate that largely consisted of the diversified sub-firms acquired by the old PC before the crash.

Among the properties Penn Central owned when Conrail was created were the Buckeye Pipeline and a 24 percent stake in New York'sMadison Square Garden (which stands above Penn Station) and its prime tenants, the New York Knicks basketball team and New York Rangers hockey team.

Though the new PC retained ownership of some rights of way and station properties connected with the railroads, it continued to liquidate these and eventually concentrated on one of its subsidiaries in the insurance business. Penn Central Corporation changed its name toAmerican Premier Underwriters in March 1994. It became part of the Cincinnati financial empire of Carl Lindner and his American Financial Group. Up until late 2006, American Financial Group still owned Grand Central Terminal, though all railroad operations were managed by the New York Metropolitan Transportation Authority (MTA) through a lease that began in 1994. The current lease with the MTA was negotiated to last through February 28, 2274.

On December 6, 2006, the U.S. Surface Transportation Board approved the sale of several of American Financial Group's remaining railroad assets to Midtown TDR Ventures LLC[7] for approximately US million. The New York Post on July 6, 2007 reported that Midtown TDR was controlled by Penson and Venture. The Post noted that the MTA would pay .24 million in rent in 2007 and has an option to buy the station and tracks in 2017. However, Argent could also opt to extend the date another 15 years to 2032.[8]

The assets included the 156 miles (251 km) of rail used by the Metro-North Railroad Harlem and Hudson Lines, and Grand Central Terminal in New York City. The most valuable asset cited by Midtown TDR were the u